College degrees may bolster future earnings potential, but they don't come cheap.

Tuition, fees and room and board averaged nearly $19,000 in 2014–2015 for a four-year public in-state university, $33,000 for a four-year public out-of-state school and $42,000 for a private non-profit four year college, according to College Board.

Few can manage the considerable cost without the help of student loans, but those who minimize the debt they incur are far better positioned to realize both their personal and professional goals later on, said Mark Kantrowitz, publisher of Edvisors.com, a college planning website.

Indeed, students who graduate with excessive loans are more likely to delay life-cycle events, such as buying a car, getting married, having children, buying a home and saving for retirement, he said.

They may also be forced to select a career path based on salary alone.

"It affects your career choices," Kantrowitz said. "You might want to go into a public-service field, but because you have too much debt, you find yourself gravitating toward a for-profit employer."

The goal, he added, is to keep total student-loan debt at graduation below your annual starting salary, thus enabling you to pay it off in 10 years or less.

Anything higher and you'll likely struggle to repay what you owe and will need alternate repayment plans. That in turn impacts your ability to consider graduate school.

Students who graduate debt-free are twice as likely as their debt-laden peers to attend a graduate or professional school, Kantrowitz explained.

That's why students and parents need to understand how important it is to properly fill out and submit the Free Application for Federal Student Aid (FAFSA). It's the form that students complete to document their financial ability to pay for college. What's more, the U.S. Department of Education uses the FAFSA to determine your eligibility for federal student aid, including low-cost loans, grants and work study. The FAFSA may also determine your eligibility for state and school aid as well.

To keep costs in check, students should maintain a 3.5 grade point average or higher to maximize scholarship opportunities and, where possible, take college-equivalent classes while still in high school, said Allan Katz, a certified financial planner and president of Comprehensive Wealth Management Group.

"Don't let the FAFSA be the last thing you do. College is about learning to ask questions, learning to negotiate, and getting comfortable with asking for what you need."-Andi Kang, president of Crown Wealth Management

"You can complete up to a year of prerequisite college classes before you even get to college — for free," he said.

Students can also save a bundle by starting off at a community college and later transferring to a larger, four-year university to complete their degree. The document on the wall looks the same, Katz said.

Perhaps the biggest way to keep college costs under control, however, is to graduate early — or at least on time.

Summer school courses at local community colleges, which cost roughly one-third the price of those at a four-year in-state school, can help students graduate ahead of schedule and shave thousands of dollars off the price of their brand-name degree.

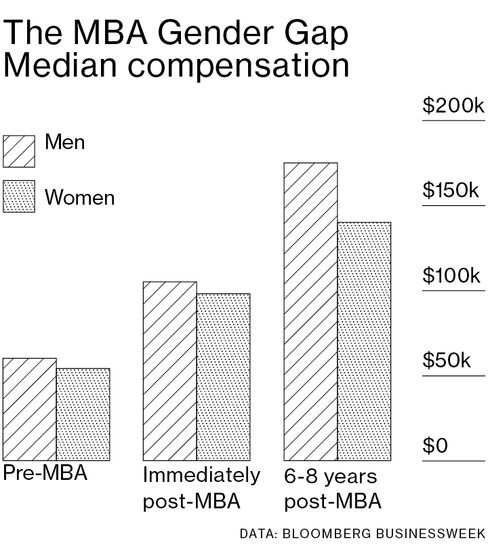

Graduate vs. undergraduate

As they budget for college expenses, students should also consider the careers they are most likely to pursue. "If you're pursuing a field that won't pay well, make sure you don't incur too much debt," said Katz, who holds college planning seminars in New York City high schools.

Think, too, about whether you will require a graduate degree to succeed in your field.

If so and money is tight, don't select such a pricey undergraduate school that you prematurely max out on student loans, thus forcing you to attend a lesser school for graduate studies — the degree that future potential employers are more likely to focus on, Katz said.

"Think about where you're going to get the biggest bang for your buck," he said. "If you go to Columbia University for undergraduate school, you may come out with $250,000 in student loans and you might not qualify to borrow more, so you would have to go to a lower-level school for graduate school.

"Suddenly you don't really stand out in the applicant pool."

Students should also, of course, apply for any and all financial aid they can find, including scholarships, grants and student loans.

That process begins, of course, with the FAFSA, which students must submit every year to be considered for most forms of student financial aid, including non-need-based federal aid.

Kantrowitz at Edvisors.com said college-bound students should file the FAFSA as soon as possible after Jan. 1, noting those who file within the first three months of the year average twice as much grant funding as those who file later in the year.

Why? Many state and college financial aid programs, which also use the FAFSA for determining eligibility, have early application deadlines. Some close in January, others in February or March.

Still other programs operate on a first-come, first-served basis until the money runs out.

"File as soon as you can," Kantrowitz said. "Don't wait until you file your tax return, and don't wait until you've been admitted to a college.

"Get the FAFSA in so you can get priority treatment in advance," he added.

Remember, too, that the formula used to determine eligibility for need-based aid is based on assets for the prior tax year.

"The formula is heavily weighted toward income, so don't artificially increase your income the year before you enroll in college," said Kantrowitz. "If you're planning to sell stocks or bonds, make sure you realize those gains before the start of the base year." Otherwise, be sure to offset those gains with capital losses.

Parents also sometimes inadvertently inflate their annual income by taking penalty-free hardship distributions from their retirement plan to pay for their child's college tuition.